Joining credit

When I joined Nubank, my interest for human behaviour, business, data models and the dry access to credit in my home country swiftly drew me to our core product: the credit card.

Most of the company’s attention was focused on shipping new products and credit card was considering expanding into other credit verticals and in need of some design love. I was excited to push this product and team to the next level.

Credit

As the company jumped into hypergrowth, I had the opportunity to build the team from the ground up to 20+ designers, and the broader business unit into a 700+ people org with engineering, design, product management, customer support, business and credit analysis, and others.

My contributions were to set the product and design culture, grow our team’s skillset, and help shape product strategy and direction as we grew in Latin America along with my peers — general manager and functional leaders.

Part of our Credit Card Design team, 2020

Impact

Our main accomplishments have been to:

1

Build a strong design team

Always ready to help each other grow in their careers

2

Outline the future vision

Keeping Brazilians' favourite credit card always fresh and meaningful to them

3

Foster a trusting and collaborative environment

For both designers and our cross-functional partners.

Let’s dive into these areas and some of the work done on each of them. As with any great band, these were a group effort and not my accomplish alone.

I’m proud of having optimised the team for autonomy and collaboration very early on. Not only did it make our growth smoother but also turned it a collective story of success. I’ll try to cover the surface, but reach out if you’d like to learn more.

1. Building a strong design team

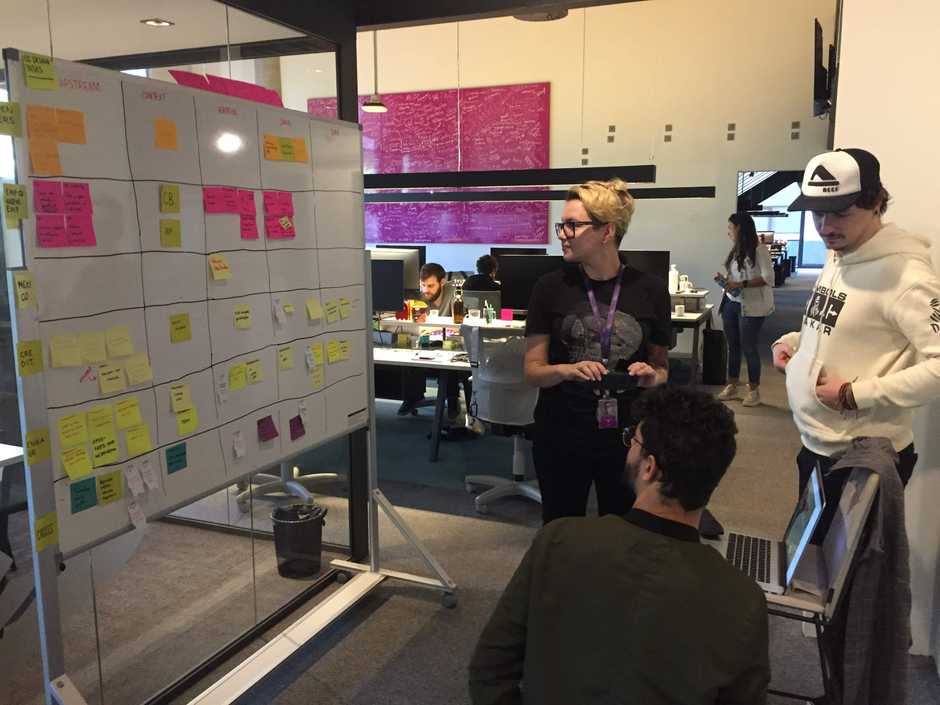

A daily sync from the early days of our team · with Diego, Leticia and Egon

Finding the right people

In 2018, Nubank hit puberty and was starting to grow fast. As with any adolescent, different parts of the body grew faster than others. Design was one that took longer to develop.

The first three people I helped hire (in the picture above) were two product designers and a UX researcher. We all had a complementary set of personalities, backgrounds and technical skills — which added a ton whenever we seeked a different perspective on the challenges we had individually.

We matched our gradient of skills and personal interests with specific moments of people’s journey with their credit cards. For example: Diego’s deep apreciation for details and visual design made him the perfect candidate to lead design for our rewards program. My interest in business and psychology led me to stay closer to limit increase policies, how people perceived them and how they should work.

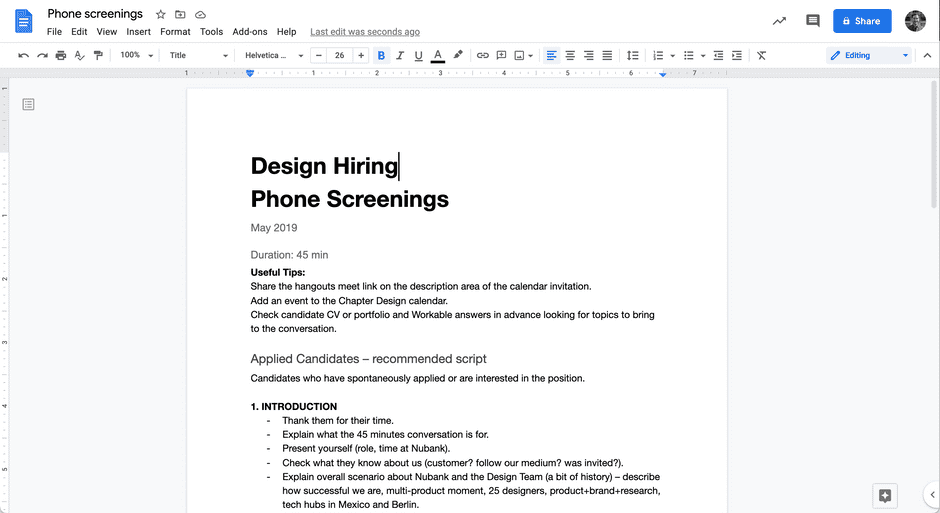

It didn’t take long for me to have weeks almost fully dedicated to hiring. It was now time for the entire team to also help find the best talent out there, so I shared my learnings and tips on interviewing design candidates.

My notes and tips for phone screening candidates. Shared with the team.

Evolving our rituals

In 2019 the team had doubled in size (around 6 people) and our rituals evolved a ton. Dailies were replaced with a hour-long weekly sync. I suggested that we shared some of the housekeeping tasks so everybody was a leader in one direction.

Diego and Ana took over the team retrospectives and Amanda volunteered to run the design critique operations, helping team members ensure they were getting the most out of their design crits.

Co-designing a better UI for the transaction feed · with Amanda, Diego, Ana

Working remote

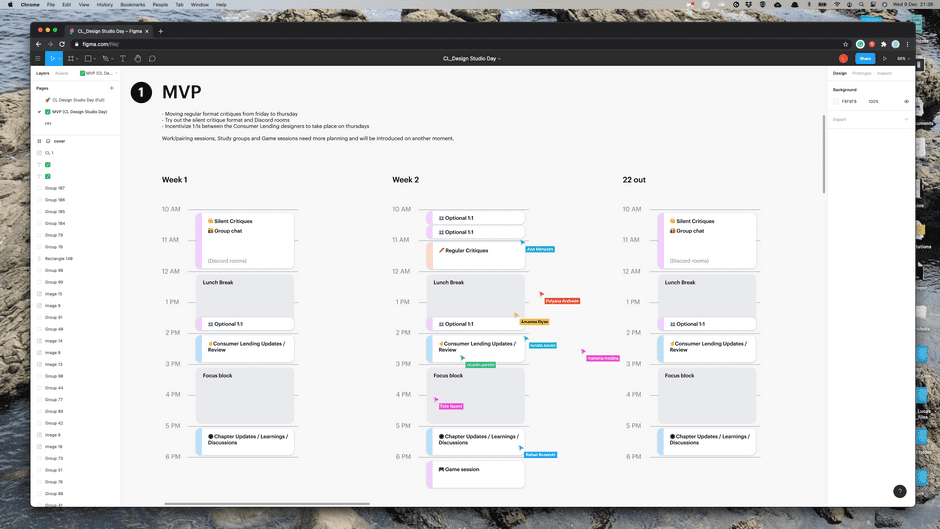

More recently, we all struggled with calendar tetris, making space for collaboration and getting to know new team members. Ana, Rafa and Poly volunteered to tackle this problem and after a round of discussions and feedback they organized a virtual “Design Studio Day” block on Thursdays. We now have a dedicated moment of the week to gather feedback, learn more about the other projects happening and get to know one another.

Growing a cohesive, connected and empowered team takes time. The integration and collaboration that comes from spending Thursdays together as a team has really paid off — especially over such a long period working from home.

Design Day agenda · organized by Ana, Poly and Rafa

2. Outlining the vision of the future

While our product vision will always remain confidential, here are some of the bits pushing us towards the right direction.

Recovering the Nu magic

Ultravioleta card · by Diego Vieira and Ariane Morganti

Nubank originally surprised customers with the level of thought and attention to critical moments. We stand out in the crowd for how we deal with bad experiences with our service. We excel at what other companies would see as “edge cases”.

As we grew, some of these critical moments were left behind. Over the past year and a half the team has dedicated time and attention to get these moments right.

Ana, for example, worked on enabling customers to create agreements and pay off debt in the app — previously only possible via customer support. This has increased by 20% the number of “healed” customers.

Paying off debt in the app. 20% increase in the number of healed customers · designed by Ana

Being respectful and transparent about how we use customer data

Credit analysis can feel like a total enigma. The Nu in Nubank translates to naked or nude in portuguese and we are continuously looking for ways to increase transparency.

A great example of that is the new loading pattern introduced by Williams (product designer) and Mariana Medina (UX writer). The new solution gives more clarity about what data we use when evaluating a credit limit increase. Not only customers exposed to this design changed behaviour (depositing more money in their account, paying bills on time) but it also increased limit utilization – good design really is good business.

This pattern has now spread to other teams and is the new standard across the company as we continue on our fight against complexity.

More transparency on what data we use for credit analysis · by Williams and Mariana Medina

Adapting to customers needs during the pandemic

The covid crisis in 2020 hit the whole world in many unexpected ways. In Brazil alone, over 8.9 million lost their jobs from January to March. We promptly changed the storyline and the product backlog for the year at lightning speed. Our new goal was to be partners to customers and find way for both them and the company to weather the storm.

Amanda Elyss worked with multiple teams to design flows that provide better interest rates, financing options and also created a hub for donations.

Lower interest rates and more financing options during the pandemic · by Amanda and the Acquisition design team

Expanding into new geographies

In 2019, I helped hire Andre and Esmeralda, the first designers in Mexico. In 2020 a similar story happened with Santiago in Colombia. In both countries, Credit Card was the first product we launched.

They worked hard expanding the frontiers of our product, originally designed for a single market, and reinvented several parts of the experience to attend both user and regulator needs in these countries. As of December 2020, there are now over 100k customers in Mexico and more than 200k in the Colombia waitlist.

Mexico and Colombia Launch · by Andre, Veronica, Esmeralda, Omar, Santiago, Claudio, and several others

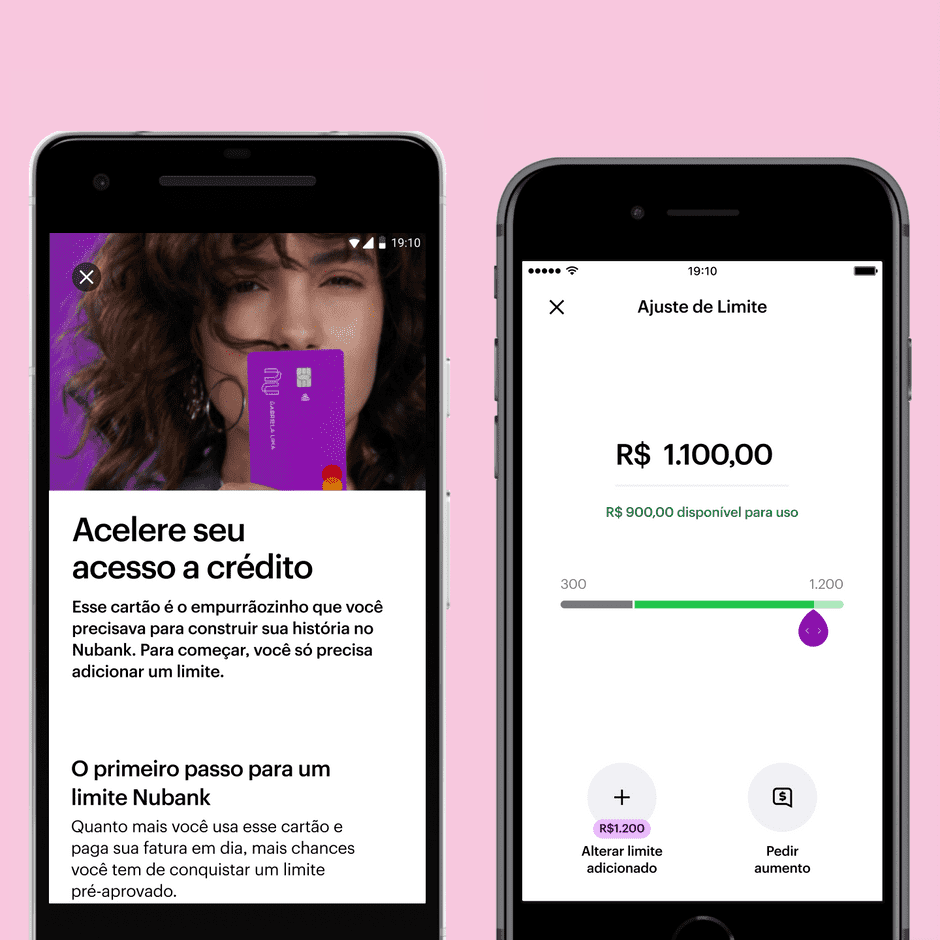

A path to credit for the next 50MM customers

Nubank’ credit card has been hugely successful1 but there’s still an expressive number of applicants that weren’t approved for the product. Since mid-2019 the largest portion of my attention has been dedicated to finding new ways of offering credit options. This has been a passion project of mine where I have participated in user research, helped define the product strategy and structure a number of experiments that are gradually progressing towards a product focused on underserved customers.

More recently, Rafael joined me in this adventure and we are now rolling out the first version of our credit building program — I can’t tell much more than that for now! We expect to onboard millions of Latin Americans to Nubank and provide them healthier tools to (re)build and use credit.

First release of our path to credit program · by me and Rafael

3. Fostering trust and collaboration with our partners

Mixing multiple lenses for understanding customers

In only 12 months the credit card customer base sky-rocketed from 3 to 12 million people. We were onboarding close to a million customers per month and the data we had on them was changing too fast to keep track of. Leticia and I worked with Elisa and Luiz (data scientists) on a foundational research framework that could be replicated and scaled so we wouldn’t have to “discard” research data every couple of months.

Our small group adopted a mixed-methods (quant/qual) approach to segment the ever growing customer base into smaller, more actionable buckets of behaviours.

This work revealed a ton of user needs, pushed us to connect credit card with other products in the Nubank ecossystem and served as the cornerstone for the product and credit strategy the Product Lead and I created for the following year.

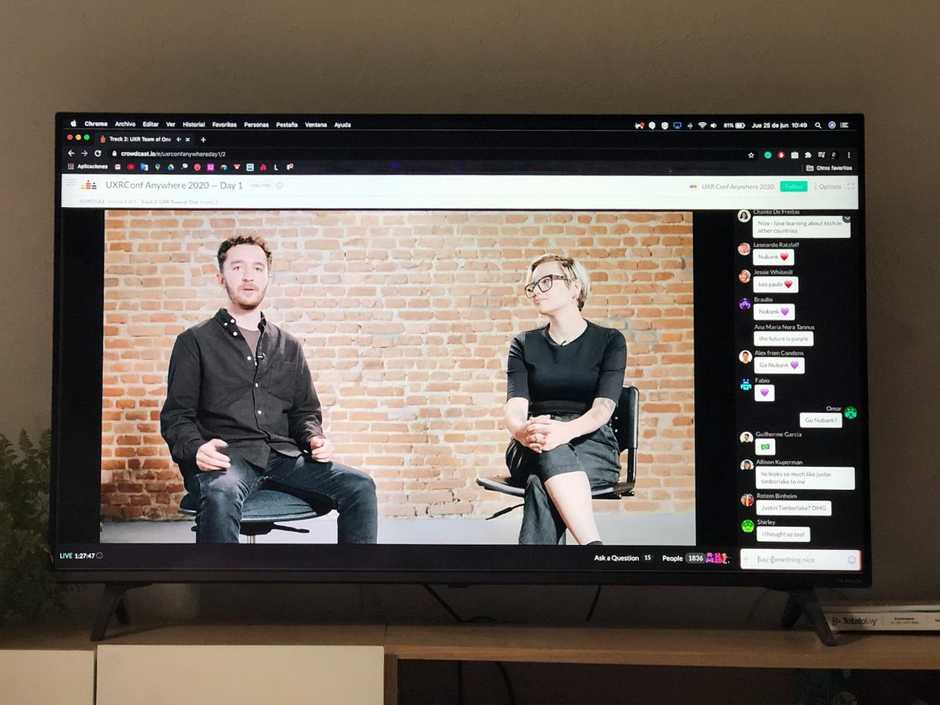

Leticia and I spoke about this process at UXR Conf in 2020.

Leticia and I worked with data scientits to develop a scalable research framework. The two of us presented it at UXR Conf.

Connecting the parts to make sense as a whole

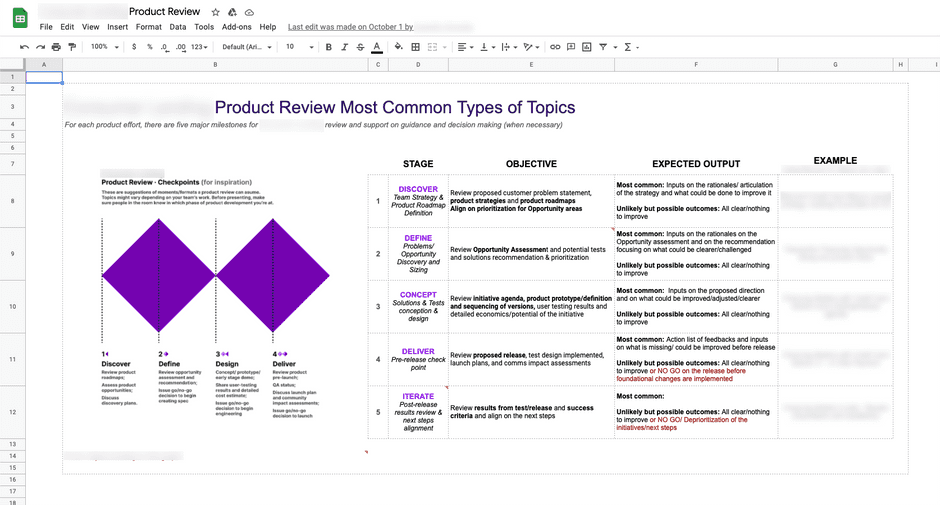

In 2018, the credit card org was a group of siloes maintaining the product operation. In my first couple of months I kickstarted a weekly forum with product, design, marketing, engineering and the general manager so teams had more visibility of the work happening, co-create an overarching strategy and align on a discovery + delivery roadmap.

Over the years, this forum took many different shapes and sizes. The current version is called Product Review. It’s a weekly session where we go deep into one specific topic and discuss it with senior leaders in the company. It’s a casual forum that people usually use to gather fresh perspective on their work or as a dry-run before presenting to the executive team.

Product Review guidelines depending on the maturity of the product — and what to expect from them. I worked on this with Mariana Penido and Amanda Legge

Co-designing with other functions

We have created the habit of bringing in other functions as early as possible in our process. Be it software engineers participating in user interviews or data scientists and customer support ideating product possibilities. This has been called out several times as a “design team” trait that spread out to other chapters — we couldn’t be happier about it!

Ideation session with Business Architects, Customer Support and Engineers

Peer Feedback

Things people told me that got me energized to do my best work.

You inspire not only designers, but PMs always reach out to get your input on their strategies, discuss ideas, and ask for advice. You’re a true partner and always demonstrate genuine care for our customers.

— Mariana Penido, Head of Product for Credit Card

Credit card is the most innovative team at Nubank. You found a way to articulate how design makes an impact in the business that I would love to replicate. I can see the team has been successful at constantly questioning what has been held true/ worked well in the past.

— Renata Veiga, Design Manager for Lending

It’s 100% clear to me that you don’t work for the Credit Card business unit but for our customers. And you know how to go all the way back to tell how these decisions have an impact on the business.

— Luiza Ferraz, Product Marketing Manager

-

Credit cards are scarce and desired in Brazil. They enable people to:

↩

A. purchase online (debit isn’t accepted in ecommerce) and B. buy more time to pay for things (which has a ton of value for home/health emergencies). Almost every merchant offers zero interest instalments when you pay with credit cards, so financing purchases is part of the culture.